REILink BRRRR Calculizer™

Master the BRRRR Method. Unlock Infinite Returns.

The Buy, Rehab, Rent, Refinance, Repeat strategy is powerful, but complex. Our BRRRR Calculizer™ provides the intelligent analysis needed to execute flawlessly at every stage.

Analyze Your BRRRR DealsWhat is the BRRRR Strategy?

The BRRRR method is a popular real estate investment strategy that stands for: Buy → Rehab → Rent → Refinance → Repeat.

Investors purchase a distressed property (often below market value), renovate it to increase its value and rentability, lease it to tenants for cash flow, and then conduct a cash-out refinance based on the new, higher appraised value. The goal is often to pull out most, if not all, of the initial capital invested, allowing the investor to "repeat" the process with another property, effectively scaling their portfolio with minimal capital left in each deal.

The BRRRR Tightrope: Why Basic Calculations Don't Cut It

The BRRRR strategy is powerful, but each stage has critical financial checkpoints. Miscalculate one, and the entire "Repeat" cycle can falter. Basic spreadsheets often fail to:

- Accurately Model Refinance Terms: Lender LTVs, interest rates, closing costs for refinancing are crucial and vary.

- Project Post-Rehab ARV Realistically: Overestimating the after-rehab appraisal value is a common pitfall leading to less cash out.

- Integrate Rehab & Rental Phases: Holding costs during rehab, accurate rental income projections, and operating expenses post-rehab all impact the refinance numbers.

- Assess "Cash Left In Deal": Understanding how much of your initial capital remains (or is pulled out) is key to the "Repeat" step.

- Analyze Post-Refinance Performance: What's the new cash flow and CoC return after refinancing with a potentially higher loan amount?

A successful BRRRR requires precision at every step. Overlooking details can trap your capital and halt your growth.

REILink BRRRR Calculizer™: Precision Across All Phases

Our BRRRR Calculizer™ is engineered to meticulously analyze each stage of the strategy, providing the intelligent insights you need to execute with confidence and maximize your ability to scale.

The Calculizer™ Edge for Your BRRRR Deals:

- Holistic Multi-Stage Analysis: Seamlessly integrates Buy, Rehab, Rent, and Refinance calculations.

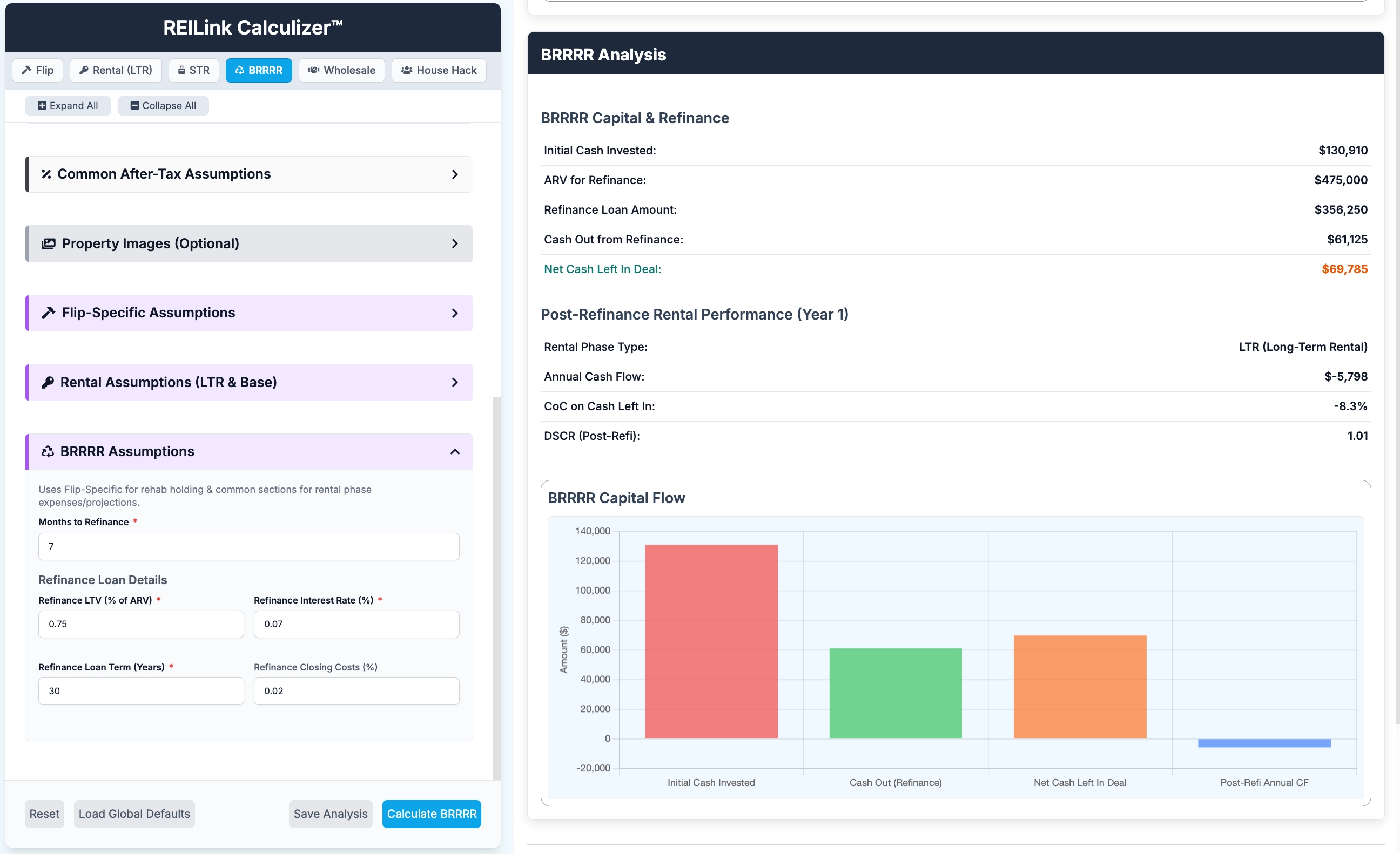

- Accurate Refinance Projections: Model various LTVs, rates, and costs to determine realistic cash-out potential.

- Cash-Left-In-Deal Calculation: Clearly see how much capital you'll recoup to fuel your next investment.

- Post-Refinance Performance: Analyze new cash flow, CoC return (on remaining capital), and DSCR after refinancing.

- ARV & Rehab Cost Precision: Leverages REILink's Repair Cost Estimator and market data for accurate valuations.

- "Repeat" Feasibility Insights: Understand if the deal structure supports sustainable portfolio growth.

Visualize and analyze every step of your BRRRR journey.

Key Features for Successful BRRRR Execution

Acquisition Analysis

Determine optimal purchase price based on the full BRRRR lifecycle projections.

Rehab Budgeting

Integrates with the Repair Cost Estimator for precise rehab cost planning critical for ARV.

Rental Performance

Project rental income, operating expenses, and NOI to satisfy lender refinance requirements.

Refinance Modeling

Simulate different loan terms, LTV ratios, and interest rates to maximize cash-out potential.

Cash Flow Post-Refi

Analyze your new cash flow, CoC (on cash remaining), and DSCR after the refinance event.

"Repeat" Viability Score

Assesses how effectively you recouped capital and whether the deal fuels sustainable portfolio growth.

Unlock the True Power of BRRRR. Analyze with REILink.

Stop leaving capital on the table or getting stuck mid-strategy. The REILink BRRRR Calculizer™ provides the comprehensive analysis you need to buy right, rehab smart, rent effectively, refinance optimally, and repeat successfully.

Explore All REILink Calculizers™Part of the powerful REILink Deal Laboratory suite.