REILink Rental Calculizer™

Master Your LTR & STR Investments. Predict Profit with Precision.

From steady long-term cash flow to dynamic short-term rental income, our intelligent Rental Calculizer™ provides the clarity you need for both LTR and STR strategies.

Analyze Your Rentals SmarterUnderstanding Rental Property Investing

Rental property investing involves purchasing real estate to generate income through tenant leases. This can take two primary forms:

Long-Term Rentals (LTR)

Typically involve standard leases (e.g., 12 months) providing consistent, predictable income. Focus is often on stable cash flow, loan amortization, and long-term appreciation.

Short-Term Rentals (STR)

Properties rented for shorter periods (days or weeks), often through platforms like Airbnb or VRBO. Can offer higher income potential but come with variable occupancy, more active management, and specific regulations.

Why Basic Rental Calculators Fall Short

Analyzing rental properties, especially with the rise of STRs, is complex. Simple calculators often miss critical variables:

- Dynamic Income Streams: Accurately forecasting STR income requires factoring in nightly rates, seasonal occupancy, cleaning fees, and platform commissions. LTRs need accurate vacancy rate projections.

- Comprehensive Expense Management: Beyond PITI, there are repairs, maintenance, property management (higher for STRs), utilities, supplies (for STRs), and capital expenditures.

- Financing Viability: Does the property meet lender requirements like Debt Service Coverage Ratio (DSCR)?

- Market Context: How do your projected returns compare to actual market performance for similar LTRs or STRs in the area?

Relying on oversimplified tools can lead to poor investment decisions, negative cash flow, and missed opportunities.

The REILink Rental Calculizer™: Clarity for LTR & STR

Our Rental Calculizer™ is uniquely designed to handle the intricacies of both Long-Term and Short-Term rental strategies, providing intelligent analysis backed by the REILink Insights Engine™.

The Calculizer™ Edge for Your Rentals:

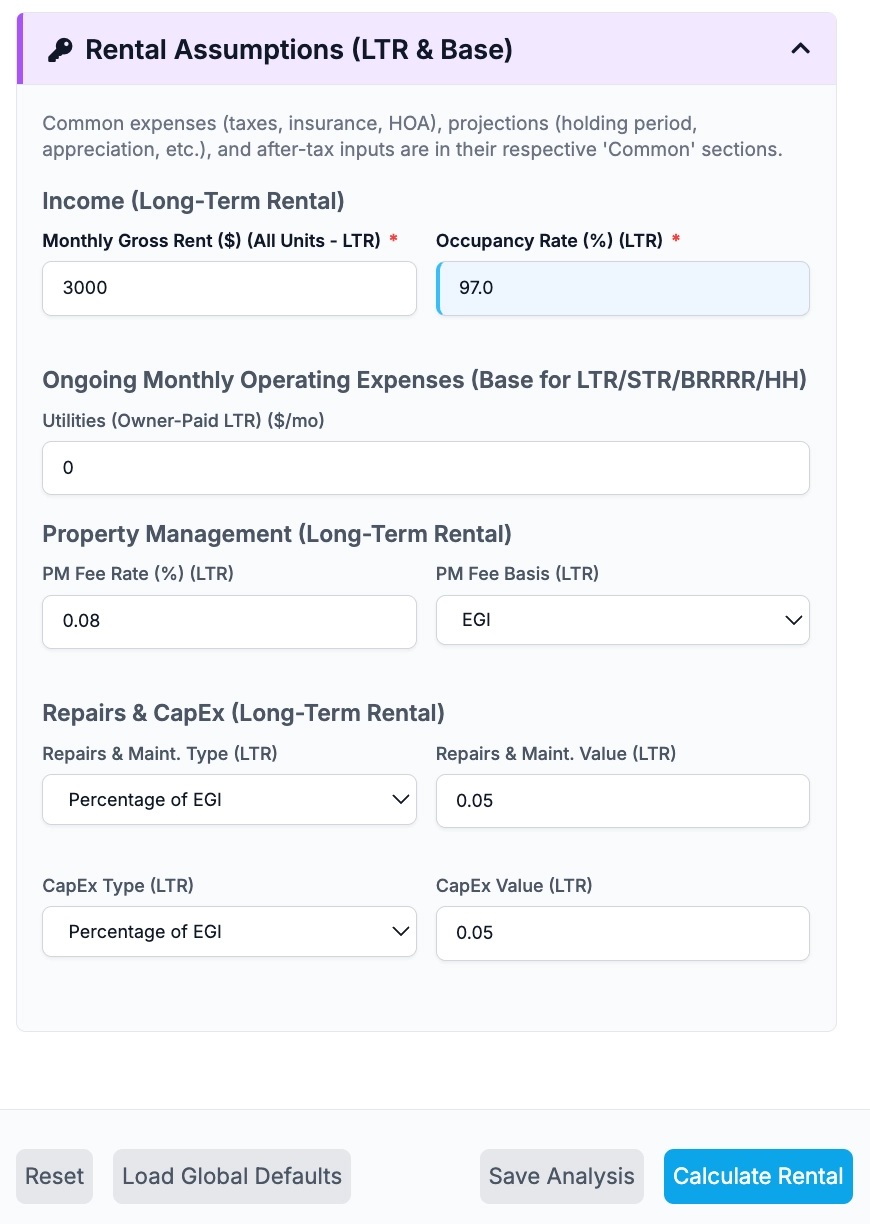

- Dual Strategy Analysis: Dedicated inputs and logic for both LTR and STR scenarios.

- Accurate Cash Flow Projections: Detailed income and expense modeling, including STR-specifics like occupancy, nightly rates, and variable costs.

- Key Performance Indicators: Instantly calculate CoC Return, Cap Rate, DSCR, OER, Net Operating Income (NOI), and more.

- Financing & Refinance Modeling: Assess loan viability and explore BRRRR potential by integrating refinance scenarios.

- Market-Aware Insights: (Conceptual) Compares your projections to REILink's market data for rental rates, occupancy, and demand.

- Expense Customization: Tailor expense categories to match your specific property and management style.

Analyze LTR & STR scenarios with detailed financial breakdowns.

Key Features for Savvy Rental Investors

Detailed Cash Flow Analysis

Project monthly and annual pre-tax and after-tax cash flow for LTR and STR models.

Return Metrics (CoC, Cap Rate)

Understand your Cash-on-Cash Return and Capitalization Rate to evaluate investment efficiency.

DSCR & Loan Viability

Calculate Debt Service Coverage Ratio to assess if the property can support financing for LTR, STR, and BRRRR strategies.

STR-Specific Inputs

Model Short-Term Rentals with inputs for average nightly rate, occupancy percentage, cleaning fees, and management costs.

Long-Term Projections

Visualize potential equity growth, loan paydown, and appreciation over your desired holding period.

REILink Insights Engine™

Receive intelligent feedback on your rental projections, comparing them to market benchmarks and best practices.

From Steady LTRs to Dynamic STRs, Analyze with Unmatched Clarity.

The REILink Rental Calculizer™ empowers you to make informed decisions, optimize your portfolio, and achieve your rental investment goals.

Discover All REILink Calculizers™Part of the powerful REILink Deal Laboratory suite.