House Hack Your Way to Financial Freedom.

Live for less (or even free!) while building equity. Our House Hack Calculizer™ simplifies the complex numbers so you can confidently analyze multi-unit income, owner-occupant loans, and true net living costs.

What is House Hacking?

House hacking is a real estate strategy where you live in one part of a multi-unit property (like a duplex, triplex, or fourplex) and rent out the other units. The rental income from tenants helps cover some or all of your mortgage payment, property taxes, insurance (PITI), and other expenses.

The goal is to significantly reduce or even eliminate your personal housing costs, allowing you to save more, invest further, and build wealth through real estate while benefiting from owner-occupant financing advantages.

The Power of House Hacking

Live for Free (or Cheap!)

Rental income from other units can cover your mortgage, effectively slashing your biggest monthly expense.

Build Equity Faster

While tenants help pay down your mortgage, you gain equity and benefit from property appreciation.

Easier Entry to Investing

Owner-occupant loans often have lower down payment requirements and more favorable terms than pure investment loans.

Learn Landlording Firsthand

Gain valuable property management experience while living on-site, with lower risk.

Reduced Financial Risk

Multiple income streams from different units provide a buffer if one unit is vacant.

Accelerate Financial Independence

Drastically cutting housing costs frees up capital to save, invest, and reach your financial goals sooner.

The Complexity of House Hack Math

While incredibly beneficial, analyzing a house hack involves juggling more variables than a typical single-family rental:

- Multiple Income Streams: Accurately projecting rent from each unit.

- Shared vs. Separated Expenses: How are utilities, repairs, and maintenance allocated?

- Net Living Cost: What's your actual out-of-pocket housing expense after all income and costs?

- Owner-Occupant Financing Nuances: How do FHA, VA, or conventional owner-occupant loans impact your down payment, PMI, and overall numbers?

- Savings vs. Market Rent: Quantifying the true financial benefit compared to renting a similar unit for yourself.

A dedicated tool is essential to accurately model these scenarios and make a confident house hacking decision.

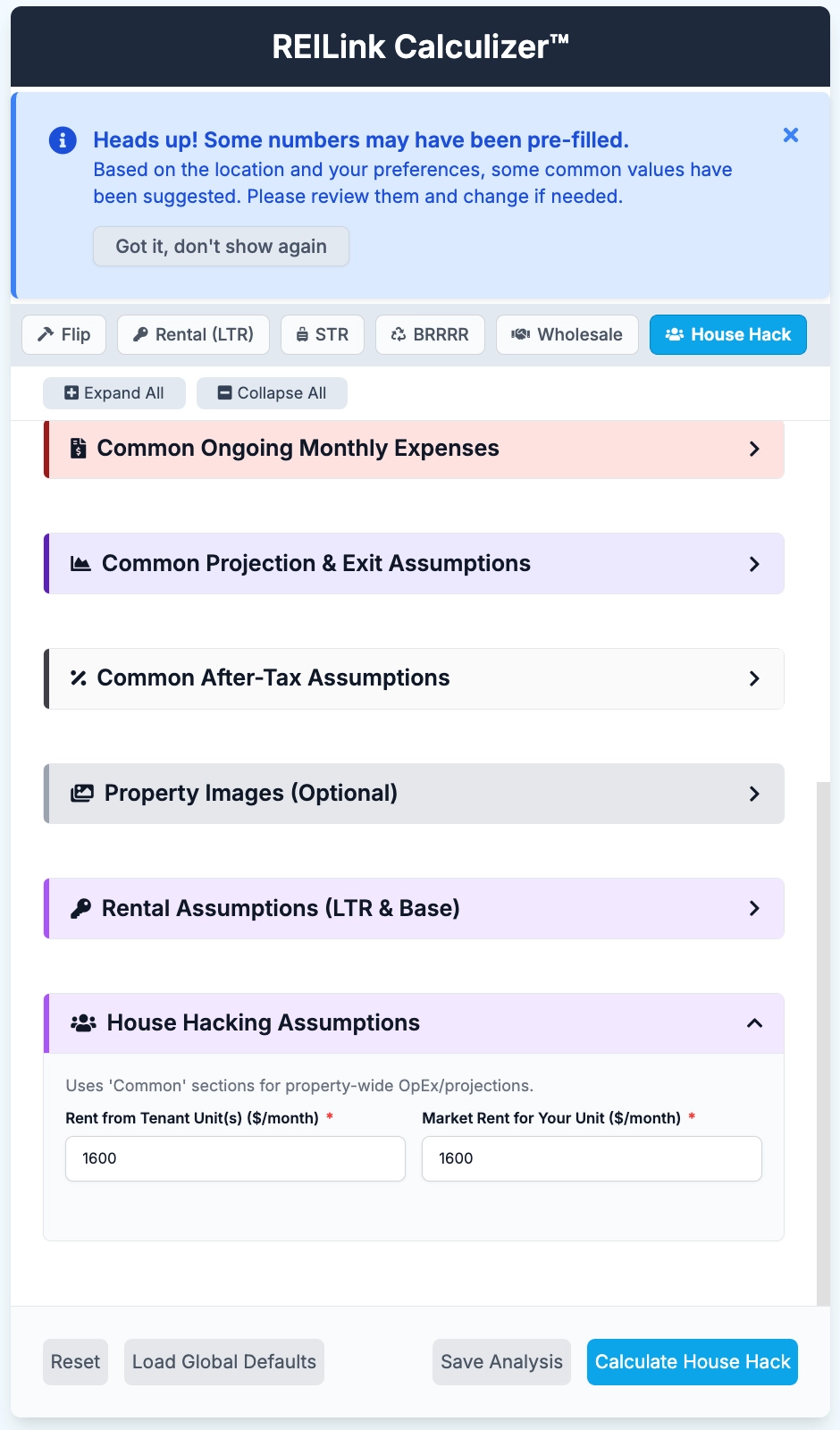

REILink House Hack Calculizer™: Your Path to Smart Living

Our House Hack Calculizer™ is specifically engineered to simplify these complexities, giving you clear insights into the financial viability and benefits of your potential house hack.

The Calculizer™ Edge for House Hackers:

- Net Living Cost Analysis: Clearly see your effective monthly housing expense after factoring in rental income.

- Savings vs. Renting Comparison: Quantify how much you'll save compared to traditional renting.

- Multi-Unit Income & Expense Modeling: Input details for each unit to get a comprehensive financial picture.

- Owner-Occupant Loan Scenarios: Factor in specific loan types (FHA, VA, conventional low down payment) and their impact.

- Vacancy & Repair Allocations: Intelligently account for potential vacancies and allocate repair costs across units.

- Long-Term Wealth Projection: Understand equity build-up and potential for future investment.

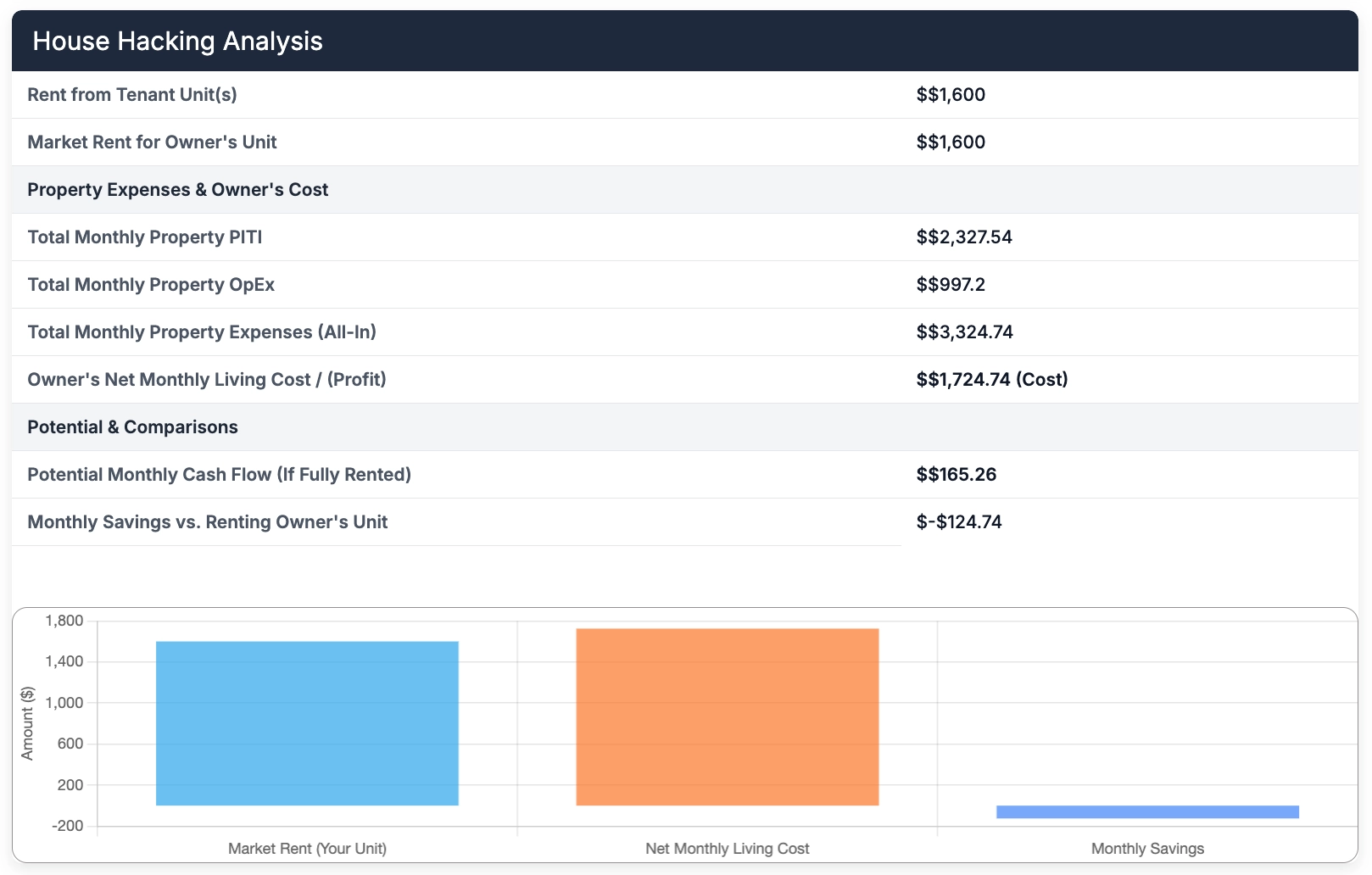

Detailed breakdown of income, expenses, and your net living cost.

Ready to Hack Your Housing & Build Wealth?

The REILink House Hack Calculizer™ provides the clarity and confidence you need to make smart, life-changing investment decisions.

Explore All REILink Calculizers™Part of the powerful REILink Deal Laboratory suite.