Comparative Analysis: Choose Your Optimal Strategy.

Don't just analyze one path. REILink's Comparative Analysis Calculizer™ lets you evaluate multiple investment strategies side-by-side for any given property, aligning financial outcomes with your unique goals and risk tolerance.

What is Comparative Deal Analysis?

Comparative Deal Analysis is the process of evaluating a single property through the lens of multiple potential investment strategies (e.g., Flip, LTR, STR, BRRRR, Wholesale) to determine which approach offers the best alignment with an investor's specific financial goals, risk appetite, capital availability, and time commitment.

It answers critical questions like: "Should I flip this property, rent it out long-term, or try short-term rentals? Which strategy offers the highest profit? Which has the best cash flow? Which requires the least capital? Which is the fastest to execute? Which carries the lowest risk?"

Why Basic Comparisons Fall Short

Apples to Oranges

Comparing a quick flip profit to annual rental cash flow without normalizing for time, risk, and effort is misleading.

Hidden Risks & Effort

A strategy might look great on paper but involve significantly more risk or hands-on effort that isn't quantified.

REILink's Solution: Contextual Clarity

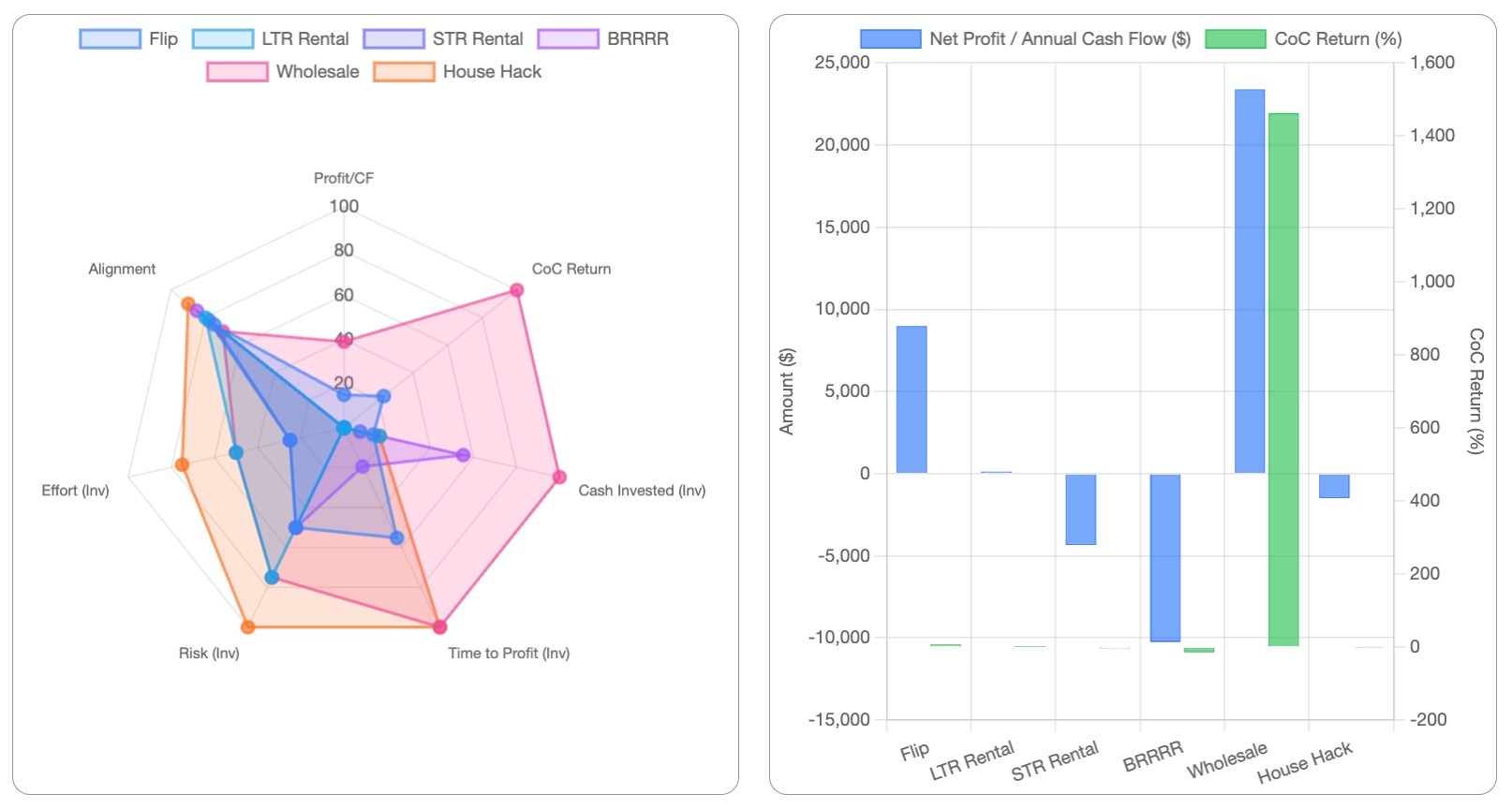

Our engine normalizes key metrics (profit, cash flow, CoC, capital, speed, risk, effort) to a common 0-100 scale for true side-by-side evaluation.

Personalized Alignment Scoring

We factor in YOUR strategy preferences and active presets (e.g., "Maximize Cash Flow," "Minimize Risk") to recommend the strategy that best aligns with YOUR goals.

The REILink Comparative Calculizer™: Intelligent Strategic Choice

Our system doesn't just show you numbers from different strategies; it synthesizes them through the REILink Insights Engine™ to provide a clear, data-driven recommendation.

1. Analyze Multiple Strategies

Run detailed calculations for Flip, LTR, STR, BRRRR, Wholesale, and House Hack scenarios on the same property using our specialized Calculizers™.

2. Normalize Key Metrics

We convert diverse outputs (profit, cash flow, CoC, capital needed, speed, conceptual risk/effort scores) to a standardized 0-100 scale for fair comparison.

3. Align with Your Goals

Your saved strategy preferences (e.g., focus on cash flow vs. quick profit) and active presets heavily influence the final alignment score for each strategy.

4. Get Top Recommendation & Trade-Offs

Receive a primary strategy recommendation with a clear explanation of why it aligns best. Crucially, also see trade-off messages highlighting the pros and cons compared to the next best options (e.g., "Flip offers highest profit, but LTR has lower risk and better long-term equity growth for this deal.").

Visualize strategy profiles with tools like radar charts.

Make Confident Decisions, Not Compromises

The REILink Comparative Analysis Calculizer™ empowers you to see the full picture. Understand the nuances, weigh the trade-offs, and confidently select the investment strategy that truly maximizes your potential for each unique property.

Try the Calculizers™ NowPart of the powerful REILink Deal Laboratory suite.